Which Depreciation Method Is Most Frequently Used In Businesses Today

Depreciation Methods

The 4 principal types

What are the Main Types of Depreciation Methods?

There are several types of depreciation expense and different formulas for determining the book value of an nugget. The well-nigh common depreciation methods include:

- Straight-line

- Double failing rest

- Units of production

- Sum of years digits

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. In other words, it is the reduction in the value of an nugget that occurs over time due to usage, wear and tear, or obsolescence. The iv main depreciation methods mentioned higher up are explained in item below.

1. Directly-Line Depreciation Method

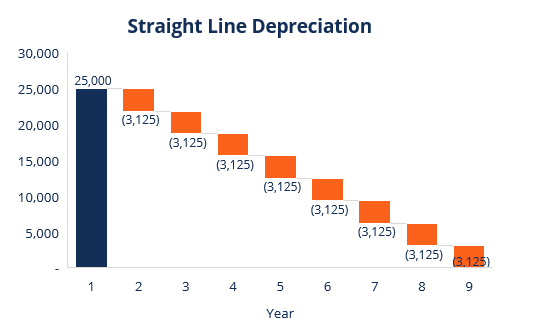

Straight-line depreciation is a very common, and the simplest, method of calculating depreciation expense. In straight-line depreciation, the expense corporeality is the aforementioned every year over the useful life of the asset.

Depreciation Formula for the Straight Line Method:

Depreciation Expense = (Cost – Save value) / Useful life

Example

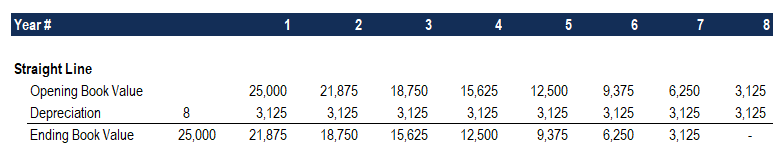

Consider a slice of equipment that costs $25,000 with an estimated useful life of viii years and a $0 salvage value. The depreciation expense per twelvemonth for this equipment would be every bit follows:

Depreciation Expense = ($25,000 – $0) / 8 = $3,125 per year

2. Double Declining Balance Depreciation Method

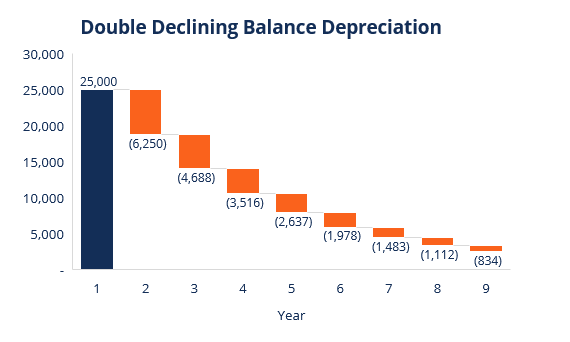

Compared to other depreciation methods, double-declining-balance depreciation results in a larger amount expensed in the earlier years as opposed to the after years of an asset'due south useful life. The method reflects the fact that assets are typically more productive in their early on years than in their later years – also, the practical fact that any nugget (recollect of ownership a car) loses more of its value in the first few years of its employ. With the double-failing-balance method, the depreciation factor is 2x that of the straight-line expense method.

Depreciation formula for the double-declining residual method:

Periodic Depreciation Expense = Beginning book value x Rate of depreciation

Example

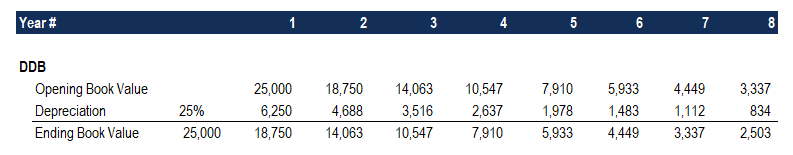

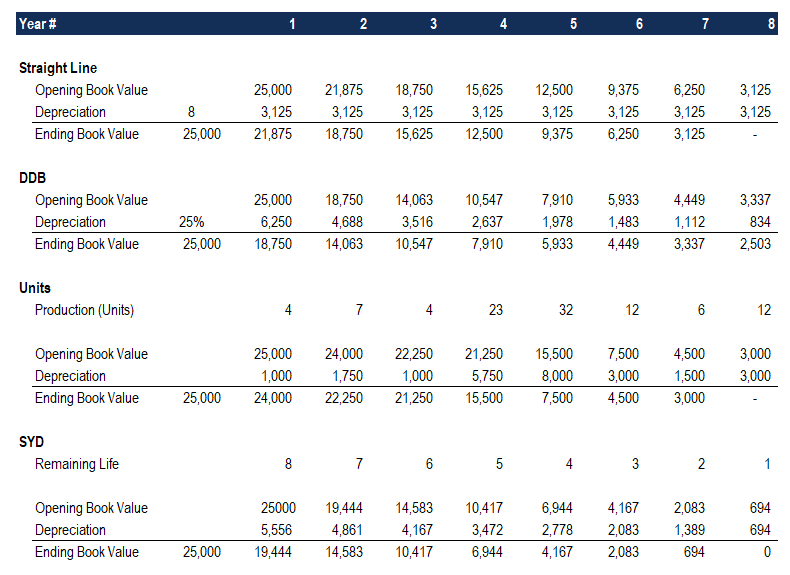

Consider a slice of holding, plant, and equipment (PP&E) that costs $25,000, with an estimated useful life of 8 years and a $2,500 salvage value. To calculate the double-declining balance depreciation, set upwards a schedule:

The information on the schedule is explained below:

- The beginning book value of the asset is filled in at the get-go of year 1 and the salvage value is filled in at the end of twelvemonth viii.

- The charge per unit of depreciation (Rate) is calculated as follows:

Expense = (100% / Useful life of asset) x 2

Expense = (100% / 8) x 2 = 25%

Note: Since this is a double-declining method, we multiply the rate of depreciation by 2.

3. Multiply the rate of depreciation past the first book value to decide the expense for that year. For example, $25,000 x 25% = $six,250 depreciation expense.

4. Subtract the expense from the beginning volume value to arrive at the catastrophe volume value. For case, $25,000 – $half dozen,250 = $18,750 catastrophe volume value at the cease of the first year.

5. The ending book value for that year is the start volume value for the post-obit year. For example, the year 1 ending book value of $xviii,750 would be the year 2 outset book value. Repeat this until the terminal year of useful life.

Learn more in CFI'due south Accounting Courses.

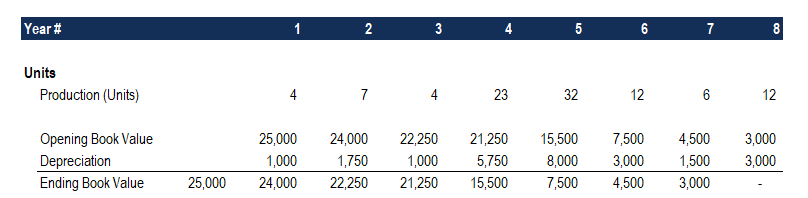

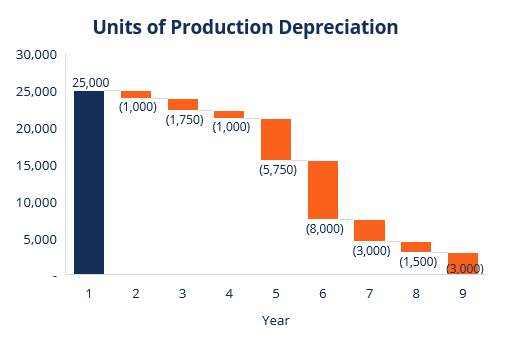

3. Units of Production Depreciation Method

The units-of-product depreciation method depreciates assets based on the full number of hours used or the total number of units to be produced by using the asset, over its useful life.

The formula for the units-of-product method:

Depreciation Expense = (Number of units produced / Life in number of units) x (Cost – Salvage value)

Example

Consider a car that costs $25,000, with an estimated total unit product of 100 million and a $0 relieve value. During the first quarter of activeness, the auto produced iv million units.

To calculate the depreciation expense using the formula above:

Depreciation Expense = (4 million / 100 million) x ($25,000 – $0) = $1,000

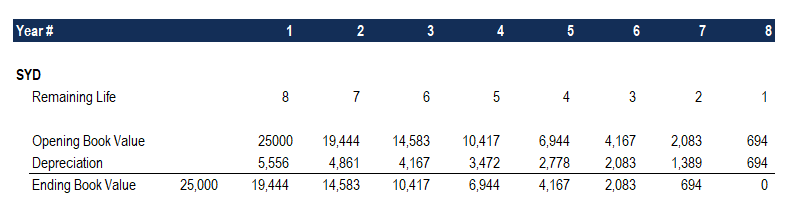

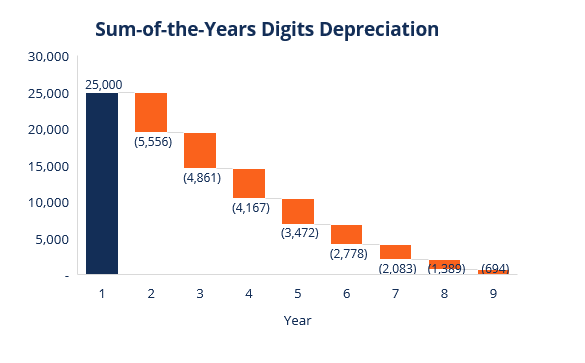

4. Sum-of-the-Years-Digits Depreciation Method

The sum-of-the-years-digits method is one of the accelerated depreciation methods. A higher expense is incurred in the early years and a lower expense in the latter years of the nugget's useful life.

In the sum-of-the-years digits depreciation method, the remaining life of an asset is divided by the sum of the years so multiplied by the depreciating base to determine the depreciation expense.

The depreciation formula for the sum-of-the-years-digits method:

Depreciation Expense = (Remaining life / Sum of the years digits) x (Price – Salvage value)

Consider the following instance to more easily understand the concept of the sum-of-the-years-digits depreciation method.

Example

Consider a piece of equipment that costs $25,000 and has an estimated useful life of viii years and a $0 salvage value. To calculate the sum-of-the-years-digits depreciation, prepare a schedule:

The information in the schedule is explained below:

- The depreciation base is constant throughout the years and is calculated equally follows:

Depreciation Base of operations = Cost – Salvage value

Depreciation Base of operations = $25,000 – $0 = $25,000

two. The remaining life is but the remaining life of the asset. For example, at the beginning of the year, the asset has a remaining life of viii years. The following year, the asset has a remaining life of seven years, etc.

three. RL / SYD is "remaining life divided by sum of the years." In this instance, the asset has a useful life of 8 years. Therefore, the sum of the years would be 1 + 2 + 3 + iv + five + 6 + 7 + 8 = 36 years. The remaining life in the outset of year 1 is 8. Therefore, the RM / SYD = eight / 36 = 0.2222.

4. The RL / SYD number is multiplied past the depreciating base to decide the expense for that twelvemonth.

5. The aforementioned is washed for the following years. In the beginning of year 2, RL / SYD would be 7 / 36 = 0.1944. 0.1944 x $25,000 = $four,861 expense for year ii.

Acquire more in CFI'due south Accounting Courses.

Summary of Depreciation Methods

Beneath is the summary of all four depreciation methods from the examples in a higher place.

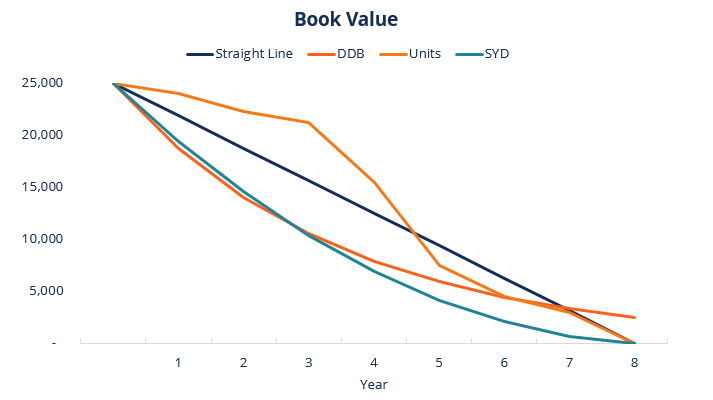

Here is a graph showing the book value of an asset over time with each different method.

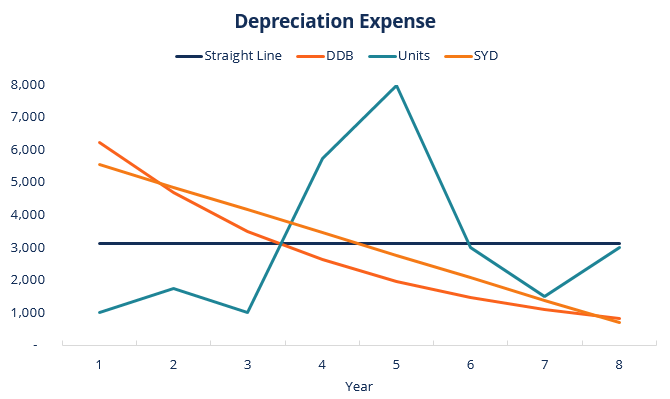

Here is a summary of the depreciation expense over time for each of the 4 types of expense.

Download the Free Template

Enter your proper noun and e-mail in the form below and download the free template now!

Depreciation Methods Template

Download the gratuitous Excel template at present to advance your finance noesis!

Video Explanation of Depreciation Methods

Below is a short video tutorial that goes through the four types of depreciation outlined in this guide. While the direct-line method is the virtually mutual, there are likewise many cases where accelerated methods are preferable, or where the method should exist tied to usage, such as units of product.

Video: CFI's Financial Analysis Courses.

More Resources

Thank you for reading this CFI guide to the four main types of depreciation. To help you get a world-class financial analyst, these additional CFI resources will be helpful:

- Depreciation Schedule

- Depreciation Expense

- Projecting Balance Sheet Items

- Property, Constitute & Equipment (PP&Eastward)

Which Depreciation Method Is Most Frequently Used In Businesses Today,

Source: https://corporatefinanceinstitute.com/resources/knowledge/accounting/types-depreciation-methods/

Posted by: allenthwary.blogspot.com

0 Response to "Which Depreciation Method Is Most Frequently Used In Businesses Today"

Post a Comment